Cyber Risk Maganement, Powered By AI

Defining The Shift From Legacy GRC to Modern Risk-Led Performance.

Step 1: Start With A Foundation Built for Modern Risk Management

A modern foundation ensures your risk program directly supports the needs of the business. With the right structure in place, organizations can prioritize effectively, invest wisely, and improve outcomes across the enterprise.

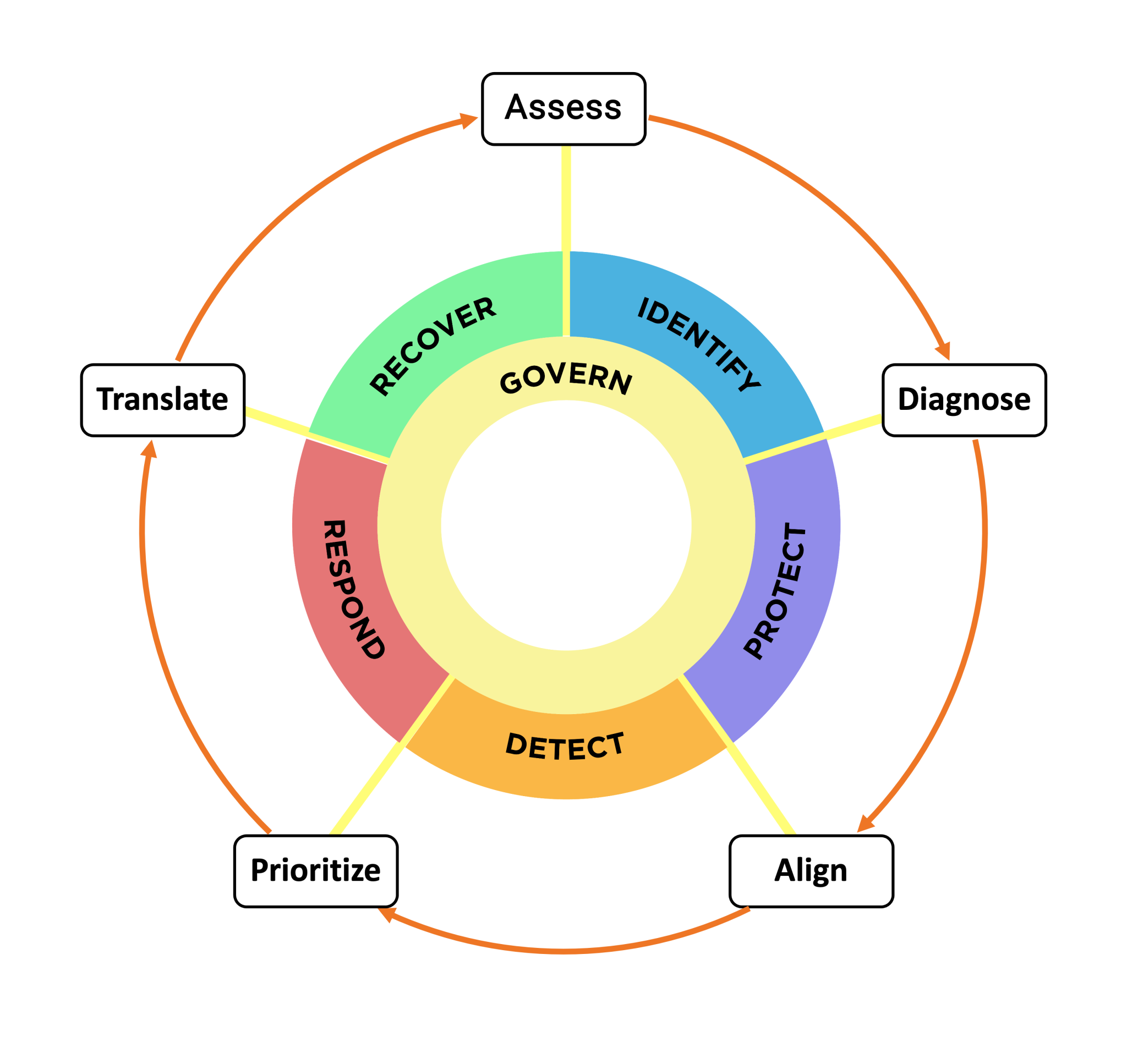

The ADAPT™ Cyber Risk Model Enabled by

Step 2: Select Controls That Align With Real Organizational Risk

Effective risk management starts with aligning controls to actual conditions on the ground. When your chosen framework reflects your real-world operations, decisions become clearer, performance accelerates, and risk declines.

Step 3: Assess the Maturity of Your Cyber Program

Continuously measuring maturity creates the clarity leaders need to demonstrate due care, informed decision-making, and responsible oversight. By establishing a measurable baseline of program performance, organizations not only strengthen their defensibility and standard of care, but also gain the insight required to direct investments toward the controls and initiatives that deliver the greatest financial impact and risk reduction.

Step 4: Diagnose the Conditions That Are Driving Your Business Risk

A structured diagnosis connects cyber weaknesses directly to business liability, giving leadership the evidence needed to make responsible decisions. This clarity supports both strategic planning and the duty to manage risk proactively.

Step 5: Align Requirements, Resources, and Accountability

Aligning these elements ensures you are prioritizing the right work with the right level of support. It also reinforces your organization’s ability to show regulators, auditors, and stakeholders that risk is being managed responsibly and in line with acceptable organizational risk thresholds.

Step 6: Prioritize the Path to Risk Reduction

Prioritizing the right actions accelerates measurable risk reduction without unnecessary disruption. It also provides leadership with clear justification for decisions, reinforcing accountability and informed governance.

Step 7: Translate Risk Into Action Leadership Supports

Aligning these elements ensures you are prioritizing the right work with the right level of support. It also reinforces your organization’s ability to show regulators, auditors, and stakeholders that risk is being managed responsibly and in line with acceptable organizational risk thresholds.

We Solved the Price Barrier For Your GRC Solution

High consulting fees and limited use of work have historically made effective GRC difficult to sustain. By transforming expertise into a scalable platform, organizations achieve enterprise-level risk governance at a fraction of the cost—without sacrificing rigor, accountability, or confidence in decision-making.

We built Minerva to compete—and to win. If you have a competitive quote, bring it. We’re confident we can deliver greater capability, stronger outcomes, and better economics.

Have any questions? Contact us!

Give us a call or drop by anytime; we endeavor to answer all inquiries within 24 hours on business days.

Common Questions Include:

- What is the best framework for my organization?

- What is the difference between compliance and negligence (you might be surprised)?

- What regulatory requirements are required for our organization?

- How do we start to build a formal GRC capability in our organization?

- Is this an “EASY” button for GRC?